In the past few years, one thing has been particularly popular in offices and living spaces in summer: sweating. The temperatures were often so high that many employees could no longer endure it in the rooms. Many companies have therefore already invested in air conditioning to cool their employees down. The devices not only have advantages for the room climate, but also benefit the companies from a tax point of view. In this article, we have looked at how you, as an entrepreneur or private individual, can save on taxes with air conditioning.

Benefits for companies & the self-employed

How you can claim an air conditioner for tax purposes always depends on the type and price of the system. Many companies choose mobile air conditioners because they offer the most tax advantages. The devices have a low purchase price and can therefore be tax deductible at once.

It is important to know that you can immediately write off air conditioners with a net purchase price of less than 800 euros (952 euros including VAT) as income-related expenses. However, this increased limit has only existed since January 1st, 2018, before that it was significantly lower, namely 410 euros net. (487 euros including VAT)

If the acquisition costs exceed these cost limits, the devices must be written off over several years. In this case, the assets are “depreciated” over a useful life of 11 years. The so-called "deduction for wear and tear" (AfA) is 9.9 percent of the purchase price every year. This percentage can then be deducted as advertising costs in the respective year, which is particularly noticeable in the case of expensive systems.

Important: In the year of purchase, the costs can only be deducted pro rata temporis, here billing is by months. So if, for example, an air conditioner was only purchased in May, the depreciation amount must be calculated down to the actual months of use.

Practical example of the depreciation of an air conditioning system: In your company you have decided on a multi-part air conditioning system that is to regulate the temperature of all rooms. The acquisition price was 8500 euros net. They bought the system back in January, so no percentage needs to be discounted in the first year. You can now deduct 9.9 percent of the 8,500 euros per year as income-related expenses, which means 841 euros per year. After eleven years, you stopped using the air conditioning system altogether.

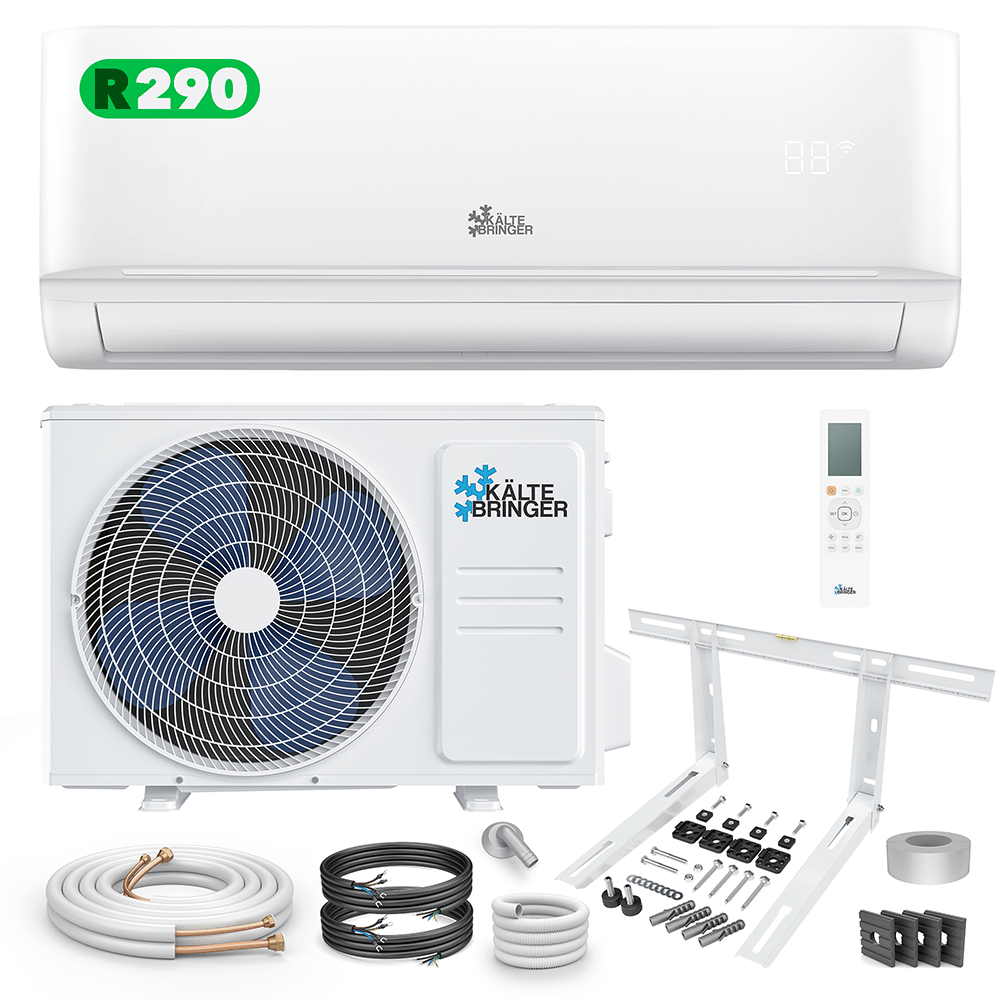

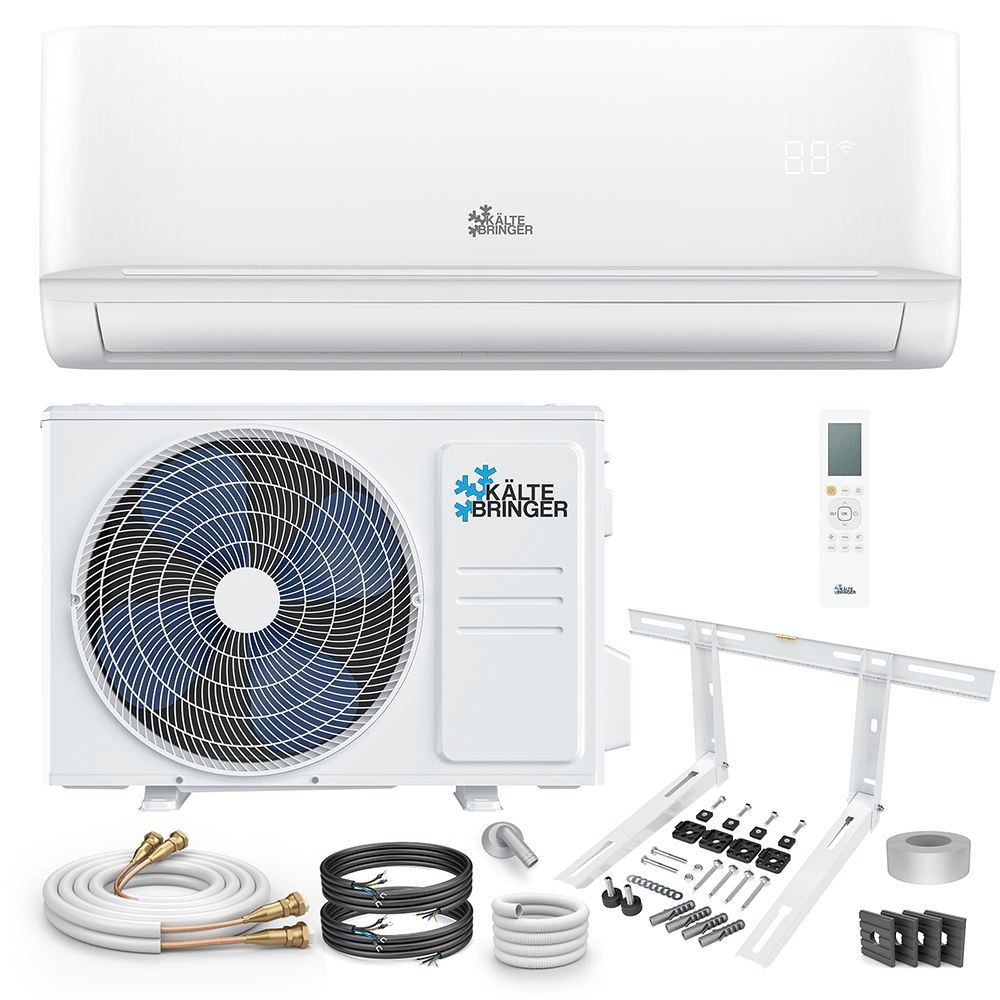

Bringing the cold Air conditioning brings with it some of the tax benefits in addition to the many health benefits. Our systems are already available for less than 800 euros net, so many of the devices can be tax deductible “in one fell swoop”. In this way, you not only create incentives for new employees, but also benefit from the devices yourself.

Air conditioning in the study: a tax advantage

Over the past few years, more and more employees have migrated to the home office. This is mainly due to the time advantages that result from this. For many people, this makes it possible to combine work and family life, so many people were able to take care of their children themselves during the lockdown. To make working in high outside temperatures more bearable, many workers have already opted for air conditioning. But have you taken advantage of the tax benefits to which you are entitled?

The decisive factor for deducting an air conditioning system in the office is the maximum amount for equipping a study of 1,250 euros. Air conditioners do not belong to the "professional furnishings" because these can also be claimed for tax purposes beyond the allowance. These include, for example, the desk, a chair, an office container or the computer desk.

However, the so-called "free allowance" is only called that way, since this amount can usually be claimed for a study, regardless of the period of use. If you only work in the home office, it is possible to sell an air conditioner even if the acquisition costs are higher.

Here, too, the following should be noted: If the purchase price of your air conditioning system is more than 800 euros net, you will have to write it off over several years.

In addition to the tax advantages, air conditioning has many other advantages. Your health in particular benefits from the small, efficient cooling devices. A constant temperature in your work space will make it easier for you to concentrate in the afternoon. In addition, modern air conditioning systems, such as those from Kältebringer, filter pollutants from the air and thus ensure a fresh, pleasant indoor climate all year round. The systems have a low operating volume and can be easily controlled via a smart home connection. In the Kältebringer online shop you will find many more practical tips and tricks on the subject of air conditioning in the guide section.

More tips for your office

It is important for you to note that your study should only contain objects used for work if possible. There is the so-called 10% rule, which states that if possible only 10 percent of privately used objects should be in your study.

Each of these mostly privately used objects should have a professional use. Deductible items include:

- Loungers, rocking chairs or armchairs, for example for reading books

- Decorative elements such as vases, murals or carpets

- Sitting area with couch, chairs or armchairs for receiving guests

- Music systems or a TV if they are used professionally

You can then deduct the cost of a study from tax, regardless of the amount, if the focus of your work is in the home office. This is the case, for example, if you are a freelancer, artist or content creator and do not have another office. Even if you work as an employee and only work from home, all costs can be fully deducted.

As you can see, in most cases air conditioning comes with tax advantages. The investment can make sense, especially if you only work from home or run a company with many employees. If you observe all tax regulations and limits, nothing stands in the way of purchasing a modern air conditioning system.

As a company, you create a great incentive for new employees by purchasing an air conditioning system. Operating rooms with a pleasant temperature ensure improved productivity, more motivated employees and pleasant working even on long summer days. In our web shop you will find the right air conditioning system for every requirement and room size. Cooling systems convince with their simple operation and long service life, see for yourself.

(Note: No legal or tax advice)